Contra assets decrease the balance of a fixed or capital asset, carrying a credit balance. Contra asset accounts include allowance for doubtful accounts and accumulated depreciation. Contra asset accounts are recorded with a credit balance that decreases the balance of an asset. A key example of contra liabilities includes discounts on notes or bonds payable. Contra accounts are more commonly paired with asset accounts, such as accounts receivable or inventory, to reduce the carrying values of those assets.

How to Calculate Units of Activity or Units of Production Depreciation

- In footnote 3, the company reports, « Net property and equipment includes accumulated depreciation and amortization of $25.3 billion as of August 1, 2021 and $24.1 billion as of January 31, 2021. »

- These accounts will typically help track sales discounts, product returns, and allowances (e.g., a price reduction for a good with minor defects).

- Chartered accountant Michael Brown is the founder and CEO of Double Entry Bookkeeping.

- In an accounting system, ledger accounts are designed to contain only similar transactions and/or balances.

- Harold Averkamp (CPA, MBA) has worked as a university accounting instructor, accountant, and consultant for more than 25 years.

The account is typically used when a company initially pays for an expense item, and is then reimbursed by a third party for some or all of this initial outlay. For example, a company pays for medical insurance on behalf of its employees, which it records in an employee benefits expense account. Then, when the employee-paid portion of the expense is paid to the company by employees, these reimbursements are recorded in a benefits contra expense account.

Contra Account

To compensate for those potential deadbeat customers, you can use a Bad Debts account to serve as a contra for your A/R. In this article, we’re going on a deep dive into what exactly a contra account is, how contra accounts work, why and how you would use contra accounts and more. When the original dollar amount is kept in the original account and a separate account is used for recording the deduction, the resulting financial information becomes more transparent and helpful for stakeholders.

- The use of Allowance for Doubtful Accounts allows us to see in Accounts Receivable the total amount that the company has a right to collect from its credit customers.

- Because there is an inherent risk that clients might default on payment, accounts receivable have to be recorded at net realizable value.

- To convert your invoice management efforts to an electronic format that can easily share data with other financial systems, businesses can leverage Invoiced’s E-invoice Network.

- This make sense because Home Depot wouldn’t be carrying accounts receivable with long payment terms.

- Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism.

What is Accumulated Depreciation?

Last, for contra revenue accounts there are sales discounts, sales allowances, or sales returns. These contra revenue accounts tend to have a debit balance and are used to calculate net sales. The presence of contra expense accounts significantly influences the presentation and interpretation of financial statements. By offsetting specific expenses, these accounts ensure that the reported figures more accurately reflect the company’s net expenditures. This adjustment is particularly important for stakeholders who rely on financial statements to make informed decisions, as it provides a clearer picture of the company’s operational efficiency and cost management. In practice, contra expense accounts are often used in various scenarios, such as purchase returns, allowances, and discounts received.

As you saw in the example, contra accounts can be an important part of your financial statement analysis, but they are hard to find. Companies bury them in the footnotes and often don’t break out the actual calculation. Still, it is important when possible to consider how the net accounts contra expense account are calculated and be wary of companies that are reporting a ton of bad debts. The contra equity account treasury stock is reported right on the balance sheet. Home Depot has repurchased more than $72 billion of stock to date, with around $7 billion coming during this accounting period.

Why should one include contra accounts on a balance sheet?

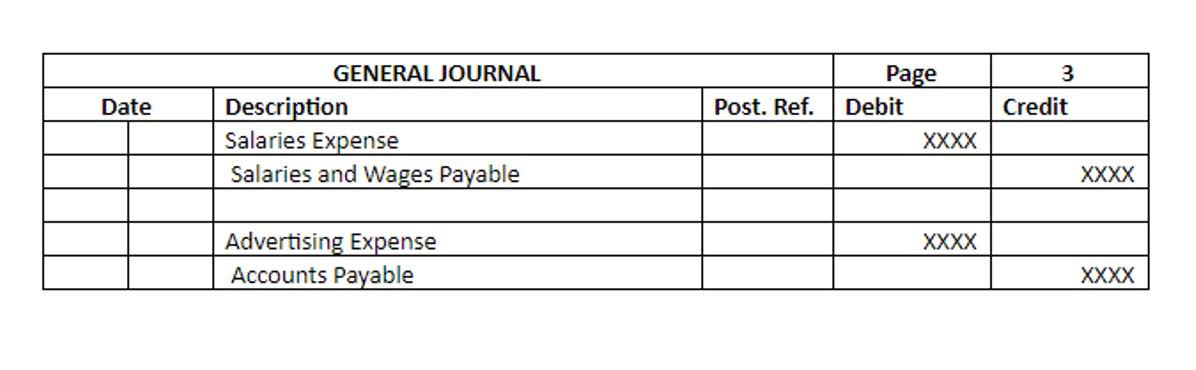

Accruing tax liabilities in accounting involves recognizing and recording taxes that a company owes but has not yet paid. An expense account which is expected to have a credit balance instead of the typical debitbalance. The net amount – i.e. the difference between the account balance post-adjustment of the contra account balance – represents the book value shown on the balance sheet.